|

||||||||||||||

|

||||||||||||||

|

||

|

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||

|

||||||

|

|||||||||

|

|

||||||||||||||||||

|

||||||||||||||||||

|

|||||||||||||||||||||

|

|||||||||||||||||||||

|

||||||||||||||||||

|

||||||||||||||||||

|

|

||

|

|

||

|

The 1,222nd CyberAlert. Tracking Media Bias Since 1996

Tuesday February 5, 2002 (Vol. Seven; No. 21)

|

CBS Illustrated Liberal Point; CBS Didn't Correct Enron Tax Story; Van Susteren's Liberal Debut on FNC; Novak's Quiz for Donaldson

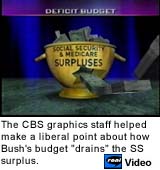

Of course, that happened nearly every year for at least 30 years. And if the government were to spend $80 billion less and have a balanced budget, not one dollar of the Social Security and Medicare "surpluses" would be spent on anything other than current programs, so what's the point? Not one penny of those surpluses in recent overall budget surplus years went toward future Social Security or Medicare needs, so highlighting the liberal polemical case only serves to scare the uninformed, which may have been the very purpose. Roberts added: "Democrats couldn't resist an attack today proclaiming the President would have stayed in the black if not for the cost of his tax cut next year." On Sunday night, David Gregory targeted the

tax cut in his NBC Nightly News story on the proposed budget as he

stressed its "cost." MRC analyst Ken Shepherd noticed that

Gregory asserted: "Democrats blame the Bush tax cut for the

disappearing surplus, which the administration wants to now make permanent

at the cost of hundreds of billions of dollars." Gregory portrayed

the tax cut as the enemy of fiscal responsibility: "Amid signs of

economic recovery, the biggest debate may be over the President's economic

stimulus plan which calls for new tax cuts at a time when the government's

finances are in the red." Back to the February 4 CBS Evening News, Dan Rather introduced the Roberts story: "President Bush today sent Congress his new budget proposal with big increases for the war plus tax cuts he says will grow the economy. Democrats say other priorities are being hurt, including Medicare and Social Security. CBS's John Roberts reports on the budget and blueprint for an election year battle." Roberts began, as taken down by MRC analyst

Brad Wilmouth: "From the red, white, and blue cover of his $2.1

trillion budget proposal to his patriotic appeal at Eglin Air Force Base

in Florida today, President Bush cast his request for record spending in

the urgent terms of national security." "The President hopes the campaign to

finance the war will give him political cover against the first deficit

budget in five years," Roberts explained just before CBS put up its

graphic of the gold kettle, labeled "Social Security & Medicare

Surpluses," with a hole in the side from which stacks of dollar bills

rapidly flowed out, "one that drains the entire Social Security and

Medicare surpluses and still ends up $80 billion in the red." When

the graphic faded, Roberts continued: "But Democrats couldn't

resist an attack today, proclaiming the President would have stayed in the

black if not for the cost of his tax cut next year." Which means Congress will be just as guilty of draining the Social Security and Medicare surpluses.

After outlining the basics of Bush's

proposed budget and running a soundbite from Bush defending it, Moran

observed on the February 4 World News Tonight: "The most important

choice in the Bush budget is a long-term one. The President has

permanently abandoned the lock box idea, which set aside $1.5 trillion in

Social Security and Medicare surpluses over the next decade. The money

will now be spent on other programs."

The Washington Post on Sunday, however, undermined the underlying story as it discovered that Enron really had paid corporate income taxes. Not surprisingly, the CBS Evening News on Monday night didn't bother run any kind of a correction. (There was no CBS Evening News on Sunday night for most of the country and the original story aired on a weekday.) FNC's Brit Hume did pick up on the development, reporting Monday night on his Special Report with Brit Hume: "Remember all those reports that Enron paid no federal income taxes? They all started with Citizens for Tax Justice, a left-leaning research group which reported that Enron had paid no taxes in the year 2000 and actually got a $278 million tax rebate. Now though the Washington Post reports that what the paper is calling 'a close review of Enron's statements combined with interviews with tax specialists indicates' that Enron did indeed pay income taxes and the story quotes an Enron spokeswoman as saying the company paid $112 million in federal taxes in the year 2000." Rather had intoned on the January 18 CBS Evening News: "The Enron scandal is encouraging new looks at a growing trend in corporate America: Using legal loopholes, including offshore hideouts, to avoid federal income taxes altogether. But legal or not, critics say it is outrageous, as CBS's Mark Strassmann reports for tonight's Eye on America." Strassmann had begun: "Enron was

America's seventh-largest corporation, but four of the last five years the

company paid not one dime in federal income taxes. To many Americans, that

in itself is a scandal." For more: http://archive.mrc.org/cyberalerts/2002/cyb20020121.asp#2 "Enron Appears to Have Paid Taxes" read the headline over the February 3 Washington Post story by Glenn Kessler, who did not call CTJ liberal, preferring to describe it as "a research group that advocates a more progressive tax system." An excerpt: One of the big unanswered questions about Enron Corp., the energy company that collapsed into financial scandal, is whether it paid federal income taxes in recent years, when it was reporting growing revenue and profits. Citizens for Tax Justice, a research group that advocates a more progressive tax system, said in a report last month that Enron paid no taxes in 2000 and received a $278 million rebate because of a big tax break for stock options cashed in by employees. But several accounting experts questioned the methodology used in the report, as did Enron officials. Karen Denne, an Enron spokeswoman, said Enron paid $112 million in federal income taxes in 2000, even after factoring in the tax break for the stock options. A close review of Enron's financial statements and interviews with tax specialists and accountants indicate that Enron also paid federal taxes because of what is called the alternative minimum tax. That is a separate tax system designed to ensure that most companies pay some tax when they earn a profit, no matter how many tax reduction techniques they use.... Part of the problem in interpreting Enron's tax payments is that a crucial detail appears only in a footnote to a footnote in the company's annual report -- and the language is vague. The footnoted item deals with the impact of the tax break for stock options. Accounting experts who examined the footnote disagreed on whether Enron's reported figure of $112 million in 2000 taxes paid included the huge tax break for stock options exercised by employees. Citizens for Tax Justice believes it does not, which is why it calculates that Enron paid no taxes, an estimate that was first reported by the New York Times and widely publicized across the country. But Denne, after examining the issue at The Washington Post's request, said the $112 million reported figure of federal taxes paid, on U.S. profits of $640 million, includes the deduction taken for stock options. The annual report says the company paid $29 million in federal taxes in 1999 after earning $357 million, and $30 million in 1998 on $197 million profit. Several experts said the dispute may be moot because it appears clear that, no matter how much Enron reduced its regular tax liability through stock options or other techniques, the company still paid taxes under the alternative minimum tax, according to Enron financial data filed with the Securities and Exchange Commission. In 2000, the data show, Enron's credits from paying the minimum tax rose by $34 million, to $254 million. Accounting experts said that is a sign the company made minimum tax payments in that year, since companies earn credits when they pay the minimum tax. The credits are carried on the books as an asset that can be used in future years to offset taxes owed. "You only get an AMT credit when you pay the alternative minimum tax," said Robert Willens, a tax analyst at Lehman Brothers. "It seems like they paid taxes."... END of Excerpt For the entire story, go to: http://www.washingtonpost.com/wp-dyn/articles/A14983-2002Feb2.html

A couple of hours earlier, appearing on the O'Reilly Factor, she defended her defense of Bill Clinton, vociferously maintaining to O'Reilly that Bill Clinton had never committed perjury. Van Susteren hadn't been on FNC's air for more than two minutes during a 1pm half hour appearance before she proclaimed her liberal political views. "A lot of money pours into" Washington, DC, she asserted in advocating campaign finance reform, "Senator McCain has been screaming about this for years." She wished: "Hopefully one of the things they'll talk about is campaign finance reform because, you know, there is such a problem." During the 1:25pm EST appearance with FNC's David Asman, Van Susteren asserted: "Fritz Hollings may be one of the few Democrats who didn't get any money from Enron. You know Enron was equal opportunity. You know there's a big problem in Washington with everyone being, you know, a lot of money pours into that city. Senator McCain has been screaming about this for years, you know there's a lot of money pouring in. It's not just the Republicans, it's also the Democrats." Actually, Hollings received $3,500 from Enron. Van Susteren elaborated on her liberal hope for more regulation as a result of the Enron situation: "Hopefully one of the other issues they'll raise, and this is my opinion, is hopefully one of the things they'll talk about is campaign finance reform because, you know, there is such a problem. You have soft money and hard money. Hard money is not such a problem because people say I'm giving, this is how much I'm giving, this is who got it. It's that soft money, when we don't know who got it and how much and that's what sort of engenders a sense of like 'what's going on in Washington?' You know, Washington is much better if it gets out on the table this is how much money we got and this is who we got it from. And I think that's where you may see finally some people getting off the dime and talking more about campaign finance reform." If hard money is okay because it's identified, why not just eliminate the hard money contribution limits? To whatever extent campaign financing is troublesome it's because of all the complicated regulations enacted after the Watergate political scandal. The lesson should be that more regulation will only create more loopholes. On Tuesday morning, ABC and NBC gave FNC some free publicity with both Good Morning America and Today running segments on Van Susteren's refurbished face.

Jim Romenesko's MediaNews (http://www.poynter.org/medianews/)

highlighted the item by Marc Malkin on the "Intelligencer" page

of the February 11 New York magazine: For the entire item, scroll down to the third entry at: http://www.nymag.com/page.cfm?page_id=5664

-- "Should taxes be cut across the board

for the rich as well as the not-so-rich?" The February 2 morning debate at one of the Marriott hotels in Crystal City, Virginia, was hosted by MRC President L. Brent Bozell. I would have plugged its two airings on C-SPAN on Saturday night, but they did not schedule it until the last-minute, though it also ran Monday morning on C-SPAN2. MRC analyst Brad Wilmouh took down

Donaldson's meanderings as he tried to re-write each question, often to

groans from the audience, in order to avoid a "no" answer: Donaldson attended the "Radford School for Girls?" Back to Donaldson on Saturday: "Fifth

question: 'Do you oppose embryonic cell research?' I do not oppose it.

I believe it's important. I believe that scientists have conclusively

demonstrated that a path to being able to cure dreaded diseases such as

Parkinson's, muscular dystrophy, cancer, and many more, lies in this

area. And I believe that those of us, and we conservatives are very, very

dedicated to human life, we wish to save it in that way. Now, the

conjuring up of the images of embryonic cell research of fetuses, we're

not talking about that. We're talking about something far, far

different. And you understand that. There are misguided people who

don't. At least he admitted he was "dodging." I'd put him down as 5 for 5 in the liberal column. Showing up each year in front of a hostile crowd, and jocularly bantering with Novak and audience questions, illustrates that no matter how much conservatives grew to despise him during the Reagan years, Donaldson has a lot more respect for conservatives than do most of his network colleagues. -- Brent Baker

>>>

Support the MRC, an educational foundation dependent upon contributions

which make CyberAlert possible, by providing a tax-deductible

donation. Use the secure donations page set up for CyberAlert

readers and subscribers: >>>To subscribe to CyberAlert, send a

blank e-mail to:

mrccyberalert-subscribe >>>You

can learn what has been posted each day on the MRC's Web site by

subscribing to the "MRC Web Site News" distributed every weekday

afternoon. To subscribe, send a blank e-mail to: cybercomment@mrc.org.

Or, go to: http://www.mrc.org/newsletters.<<<

Home | News Division

| Bozell Columns | CyberAlerts |

CBS

News assigned its graphics department on Monday to assist in illustrating

a liberal budget point. A CBS Evening News story featured a cartoon-like

graphic of a gold kettle, labeled "Social Security & Medicare

Surpluses," with a hole in the side from which stacks of dollar bills

rapidly flowed out, as John Roberts helpfully explained that President

Bush had proposed "the first deficit budget in five years, one that

drains the entire Social Security and Medicare surpluses and still ends up

$80 billion in the red."

CBS

News assigned its graphics department on Monday to assist in illustrating

a liberal budget point. A CBS Evening News story featured a cartoon-like

graphic of a gold kettle, labeled "Social Security & Medicare

Surpluses," with a hole in the side from which stacks of dollar bills

rapidly flowed out, as John Roberts helpfully explained that President

Bush had proposed "the first deficit budget in five years, one that

drains the entire Social Security and Medicare surpluses and still ends up

$80 billion in the red."

Democrats

actually tagged as "nasty" by ABC's Terry Moran. Usually

network reporters reserve that term just for conservatives, but concluding

a Monday night story Moran noted how Democrats are "saying the

administration is doing to the federal budget what Enron did to its

books." Moran suggested that spin "shows just how nasty this

election year budget battle is going to get."

Democrats

actually tagged as "nasty" by ABC's Terry Moran. Usually

network reporters reserve that term just for conservatives, but concluding

a Monday night story Moran noted how Democrats are "saying the

administration is doing to the federal budget what Enron did to its

books." Moran suggested that spin "shows just how nasty this

election year budget battle is going to get." Two

weeks ago, picking up on a New York Times story, the CBS Evening News gave

publicity to the claim of a left-wing group, naturally unlabeled, that

Enron had not paid any corporate taxes in recent years. CBS used the claim

as an excuse to air a story on how corporations use "legal

loopholes," which "critics call outrageous," to avoid

taxes.

Two

weeks ago, picking up on a New York Times story, the CBS Evening News gave

publicity to the claim of a left-wing group, naturally unlabeled, that

Enron had not paid any corporate taxes in recent years. CBS used the claim

as an excuse to air a story on how corporations use "legal

loopholes," which "critics call outrageous," to avoid

taxes. The new

face of the Fox News Channel: The team of Greta Van Susteren and Geraldo

Rivera? Barely ten minutes into the debut of her new FNC show Monday night

at 10pm EST, On the Record with Greta Van Susteren, Geraldo was on the air

with her, talking with her from Africa.

The new

face of the Fox News Channel: The team of Greta Van Susteren and Geraldo

Rivera? Barely ten minutes into the debut of her new FNC show Monday night

at 10pm EST, On the Record with Greta Van Susteren, Geraldo was on the air

with her, talking with her from Africa. Mort

Zuckerman, owner of U.S. News & World Report and the New York Daily

News, "hosted a hush-hush, $1,000-a-ticket fundraiser" for

Democratic Senator Max Baucus of Montana, New York magazine reported in

this week's issue. Also at the cocktail party attended by both of New

York's liberal Senators: NBC Chairman Bob Wright.

Mort

Zuckerman, owner of U.S. News & World Report and the New York Daily

News, "hosted a hush-hush, $1,000-a-ticket fundraiser" for

Democratic Senator Max Baucus of Montana, New York magazine reported in

this week's issue. Also at the cocktail party attended by both of New

York's liberal Senators: NBC Chairman Bob Wright. At the

Conservative Political Action Conference's annual Bob Novak-Sam

Donaldson debate about media bias on Saturday morning, Novak proposed that

many in the media try to pretend they really aren't liberal. To unmask

Donaldson's true views, Novak posed a set of five policy questions.

While Donaldson tried to evade each, his answers and non-answers showed

his beliefs match a liberal "no" reply to all of these questions

formulated by Novak:

At the

Conservative Political Action Conference's annual Bob Novak-Sam

Donaldson debate about media bias on Saturday morning, Novak proposed that

many in the media try to pretend they really aren't liberal. To unmask

Donaldson's true views, Novak posed a set of five policy questions.

While Donaldson tried to evade each, his answers and non-answers showed

his beliefs match a liberal "no" reply to all of these questions

formulated by Novak: