|

||||||||||||||

|

||||||||||||||

|

||

|

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||

|

||||||

|

|||||||||

|

|

||||||||||||||||||

|

||||||||||||||||||

|

|||||||||||||||||||||

|

|||||||||||||||||||||

|

||||||||||||||||||

|

||||||||||||||||||

|

|

||

|

|

||

|

The 1,789th CyberAlert. Tracking Liberal Media Bias Since 1996

6:45am EDT, Monday August 16, 2004 (Vol. Nine; No. 152)

|

2. Hume: Swift Vets Deserve "as Much Attention" as "AWOL" Bush

3. USA Today Takes Seriously Cuba's Claim Citizens Will Live to 120

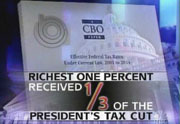

"A new study by the non-partisan Congressional Budget Office," NBC Tom Brokaw touted, "shows the average tax cut for the top earners, with an average income of $1.2 million, was $78,460. The tax cut for those in the middle, with an average income of $57,000, was $1,090." Over a graphic which announced that the "richest one percent received 1/3 of the President's tax cut," with the "1/3" enlarged in red, reporter Carl Quintanilla, who didn't bother to note the disproportionate share of taxes paid by the rich, trumpeted how the report "came practically gift-wrapped" to the Kerry campaign. And the media eagerly delivered the gift. The New York Times headlined its Friday story: "Report Finds Tax Cuts Heavily Favor the Wealthy." The Wall Street Journal: "Budget Office Says Biggest Tax Cuts Go to Richest 1%." And the Washington Post: "Tax Burden Shifts to the Middle." A Friday Reuters dispatch was headlined, "CBO Report: Bush Tax Cuts Tilted to Rich." Reporter Vicki Allen began: "One-third of President Bush's tax cuts have gone to the wealthiest 1 percent of Americans, shifting more burden to middle-income taxpayers, congressional analysts said on Friday." PBS's Jim Lehrer went with the liberal spin on the August 13 NewsHour: "President Bush's tax cuts have shifted part of the federal income tax burden from the rich to the middle class. That's the conclusion of a study released today by the U.S. Congressional Budget Office. The analysis said tax rates declined for all income levels, but translated into more savings for the wealthy than for the middle class. The CBO is a non-partisan agency. The tax calculations had been requested by Democrats in Congress. Senator Kerry used the CBO findings on the campaign today in Portland, Oregon. He told a rally the report 'documented' what he's been saying all year about the Bush tax cuts. It was Kerry's last stop on a two-week cross-country tour. Across town, Mr. Bush defended his tax policy at a terminal near the city's main port. He told small business owners the economy was getting stronger because of his 'well-timed' tax cuts." The Post's Jonathan Weisman outlined the tax burden numbers: "The CBO study, due to be released today, found that the wealthiest 20 percent, whose incomes averaged $182,700 in 2001, saw their share of federal taxes drop from 64.4 percent of total tax payments in 2001 to 63.5 percent this year. The top 1 percent, earning $1.1 million, saw their share fall to 20.1 percent of the total, from 22.2 percent. Over that same period, taxpayers with incomes from around $51,500 to around $75,600 saw their share of federal tax payments increase. Households earning around $75,600 saw their tax burden jump the most, from 18.7 percent of all taxes to 19.5 percent." Only FNC smelled a rat, as anchor Jim Angle introduced a story on Special Report with Brit Hume: "After long accusing President Bush of favoring the rich at the expense of the middle class, Democrats now say they have the headlines to prove it. But those headlines don't tell the whole story about taxes, the wealthy, or the middle class." FNC's Major Garrett alerted viewers to how "the report fails to show that the Bush tax cuts removed 14 million poor taxpayers from the income tax rolls entirely. But it does show that the Bush tax cuts mean that on a percentage basis, the wealthiest households now pay a larger share of federal income taxes under Bush than they did under Clinton." How does that correlate with the rest of the media's claim the CBO found a reduced burden on the wealthy and an increased burden on the middle class? As Garrett explained, one CBO calculation "measured all federal tax burdens, not just the income taxes affected by the Bush tax cuts. The CBO also counted payroll taxes that fund Social Security and Medicare, which the poor and middle class pay in higher percentages of income than the wealthy."

Indeed, the Washington Post's Weisman, who led his August 13 story, "since 2001, President Bush's tax cuts have shifted federal tax payments from the richest Americans to a wide swath of middle-class families, the Congressional Budget Office has found, a conclusion likely to roil the presidential election campaign," acknowledged in his 11th paragraph that "if Social Security, Medicare and other federal levies are excluded, the rich are paying a higher share of income taxes this year than they would have paid with no tax changes, the CBO found." For Weisman's story in full: www.washingtonpost.com For the August 13 New York Times article in full: www.nytimes.com In Friday's Wall Street Journal, reporter Jackie Calmes led with a sentence that could have been written by the Kerry press office: "President Bush's three tax cut laws will reduce this year's income taxes for the richest 1% of taxpayers by an average of $78,460, more than 70 times the average benefit for the middle 20% of taxpayers, congressional analysts found." Calmes soon added that the report "confirms" Democratic claims: "The report, made at the Democrats' request, confirms what the Democrats and their presidential nominee, Sen. John Kerry of Massachusetts, have charged -- that the wealthy disproportionately benefit." But the wealthy bear a disproportionate share of the income tax burden, a fact Calmes skipped over. Thank the hurricane for less bias. The distorted take on the CBO report, favorable to John Kerry, would have received much more media attention Friday if not for Hurricane Charley. ABC's World News Tonight, which spent about ten minutes on the hurricane, did not even air a campaign story. The CBS Evening News made room for a pre-publicized look at how the Bush team bars non-supporters from events, but aired nothing else campaign-related. Charley bumped Inside Politics and Crossfire off of CNN and became the focus of nearly all cable news Friday evening.

On Sunday's Meet the Press, however, fill-in host Andrea Mitchell raised the CBO report during a roundtable segment. Naturally, she relayed the liberal spin: "Well, let's talk about some of the other areas of vulnerability that the Republicans fear and that the Kerry campaign is clearly trying to exploit. Tax fairness. This week, the Congressional Budget Office, which is non-partisan, reported this week that there really is a disparity -- no big surprise here -- between the effects of the tax cut. Let's take a look at this chart. The wealthiest Americans, those whose incomes average $182,000, saw their share of federal taxes drop from 64.4 percent of total tax payments in 2001 to 63.5 percent this year while middle-income taxpayers saw their share of federal tax payments increase. John Howard, clearly this is also because the richest people pay more taxes, but how will this resonate?" Now, a full rundown of the Friday, August 13 NBC and FNC stories, followed by links to Heritage Foundation and Tax Foundation postings on Friday which dissected the CBO's numbers and how the media distorted them. -- NBC Nightly News. Tom Brokaw announced from an indoor set in Athens: "Back home on the campaign trail today, the topic was the economy and tax cuts in the wake of a new study by the non-partisan Congressional Budget Office. The study shows the average tax cut for the top earners, with an average income of $1.2 million, was $78,460. The tax cut for those in the middle, with an average income of $57,000, was $1,090. Both candidates today were just miles apart in Oregon, and NBC's Carl Quintanilla has the back and forth of the day."

NBC put "1/3" huge in red. (See the posted version of this CyberAlert for the NBC graphic.)

Quintanilla began, as checked by the MRC's Brad Wilmouth against the closed-captioning: "John Kerry's campaign still believes it's the economy, stupid. And today's report that the richest one percent of Americans received a third of President Bush's tax cut, in their view, came practically gift-wrapped." As Quintanilla proceeded to note how "at first glance, the headlines seemed to favor Kerry," NBC displayed a graphic with headlines from three newspapers: New York Times: "Report Finds Tax Cuts Heavily Favor the Wealthy" Wall Street Journal: "Budget Office Says Biggest Tax Cuts Go to Richest 1%" Washington Post: "Tax Burden Shifts to the Middle"

Quintanilla picked up: "He's hitched his campaign to economic issues. But the President, just miles from Kerry's rally in Portland today, spins it this way: Nearly everyone's taxes fell last year by some degree, and those so-called wealthy Americans are often small business owners that create jobs. But do middle class voters care how much the rich benefit so long as they pocket extra cash themselves?" -- FNC's Special Report with Brit Hume. Friday anchor Jim Angle asserted: "After long accusing President Bush of favoring the rich at the expense of the middle class, Democrats now say they have the headlines to prove it. But those headlines don't tell the whole story about taxes, the wealthy, or the middle class. Fox News correspondent Major Garrett has this analysis."

Garrett began, over a series of separate shots of the headlines in the Washington Post, New York Tikes and Wall Street Journal: "Morning headlines in Washington and New York blared the news the Bush tax cuts helped the rich and hurt the middle class. To team Kerry, it all spelled vindication and a ripe campaign issue."

On screen:

Pam Olson, Bush-Cheney advisor: "The tax cuts were clearly designed to provide benefits to income tax payers across the board. When you look at them on a percentage basis, what you find is that the tax cuts percentage benefit was greater at the lower end than it was at the higher end."

On screen:

Olson: "The higher income across the board are going to pay a greater share of the tax burden, income tax burden." The media's distortions so upset the Heritage Foundation that on Friday afternoon they posted a biting item, "The CBO Tax Report: Proof that Reporters Cannot Read." A reprint of the un-bylined report: Reuters goes gaga over a new report from the CBO. Reuters' lead: "President Bush's tax cuts have transferred the federal tax burden from the richest Americans to middle-class families, with one-third of them benefiting people with the top 1 percent of income, according to a government report cited in newspapers on Friday." Let's take a look at how the 'transfer' is going. The Richest Americans The proportion of federal taxes that will be paid by the top 20 percent of earners is higher under the Bush tax cuts from 2005 through 2010, according to the CBO report that Reuters purportedly cites. From 2011 through 2014, as far into the future as the report projects, the top 20 percent of earners will pay, under the Bush tax cuts, the same proportion of federal taxes that they would have without the Bush tax cuts. Middle Class Families The proportion of federal taxes that will be paid by the middle 20 percent of earners is slightly higher (one-tenth of a percent) in 2004 and 2006. The proportion of federal taxes that will be paid by the middle 20 percent of earners is lower in 2005, 2008, 2009, and 2012. It is unchanged in the other years through 2014, as far into the future as the CBO report projects. To Summarize And it's not just Reuters. The Post, for example, headlines "Tax Burden Shifts to Middle," which is a good headline, if false Don't believe us? END of Reprint For the CBO's report: www.cbo.gov

The Heritage item is posted at: www.heritage.org Hodge also detailed some of the parameters CBO used which generated the numbers the media embraced, such as using "household" data instead of "tax filer" data as is normally done. For, "Cautionary Notes for Comparing CBO's Household Data to Standard Tax Data," see: www.taxfoundation.org

At nearly the identical moment in another part of Washington, DC, NBC's Andrea Mitchell was illustrating the media's bias on the subject as she raised the ad produced by Swift Boat Veterans for Truth with her Meet the Press roundtable not to discuss the charges, but to fret about how the group is able to buy TV ads: "Now we've got these ads by the Swift Boat Veterans, the so-called 527 ads, and they've been very prominently placed, and of course we then replay them. But John Harwood, they are paid for by prominent Texas Republicans, yet they get around the campaign finance law by claiming that they're non-political." In fact, in her story for NBC Nightly News on the ad, Mitchell did not let NBC viewers hear a second of the points made by the dozen or so Vietnam veterans featured in the ad.

During the panel segment on the August 15 Fox News Sunday, Hume asserted: "The book, Unfit for Command, is a remarkably well-done document. It is full of detail. It is full of specifics. The charges that are being made of Kerry, of irresponsible and indeed in some cases mendacious conduct in his service in Vietnam, are made by people who were there. They're making the charges in their own names. There's not a lot of, this isn't a bunch of anonymous people whispering things. It's all out there in the open. The book is full of footnotes. It has an appendix. It's a pretty serious piece of work. Hume got cut off at that point and after an ad break Juan Williams argued that the vets have been debunked, a contention disputed by Hume.

At about the same time on Meet the Press, which like Fox News Sunday is produced at 9am EDT, fill-in moderator Andrea Mitchell lamented: "Kerry, of course, made his military service in Vietnam the central metaphor of Boston, of the convention, and now we've got these ads by the Swift Boat Veterans, the so-called 527 ads, and they've been very prominently placed, and of course we then replay them. But John Harwood, they are paid for by prominent Texas Republicans, yet they get around the campaign finance law by claiming that they're non-political." Much to the consternation of NBC. The August 7 CyberAlert recounted how Mitchell tried to discredit the ad and how ABC's World News Tonight has pretended it never existed.

An excerpt: Back on July 29, the night of Kerry's convention speech, ABC's Peter Jennings introduced a taped interview with Kerry by noting how "Kerry's campaign certainly believes that his service in Vietnam is a huge asset in this campaign." Jennings, however, observed that "there are a few who served with him who dispute his record and question his leadership" and, Jennings promised, "we'll hear from them in the weeks ahead." We're still waiting. Maybe if the networks had covered the fact that a significant number of those who knew Kerry in Vietnam don't trust him or support him, the vets wouldn't have had to have resorted to buying TV time to get an airing for their views.... Tom Brokaw announced Friday night that "a harsh political ad attacking Senator John Kerry's Vietnam war record is putting the spotlight back on the independent organizations which are called 527's. They're raising money and running ads separate from the campaigns and the parties themselves. And as NBC's Andrea Mitchell tells us tonight, the campaign finance law supposed to fix the system left this very big loophole." Mitchell's story failed to air any of the audio from the ad, but she ominously reminded viewers that "some of the same players organized anonymous attack ads against John McCain four years ago, when he was running against George Bush." Mitchell lamented how "at a campaign picnic today, the President refused to disavow it."... END of excerpt.

For the August 7 CyberAlert article in full: www.mediaresearch.org

For summaries of many CyberAlert articles this year which recounted media coverage, or lack thereof, for the anti-Kerry Vietnam veterans while the networks touted Kerry's "band of brothers" and bashed Bush over questions about his National Guard service, see this August 12 CyberAlert item: www.mediaresearch.org

USA Today on Friday lent its news pages to a Havana-datelined story, ostensibly tied to Fidel Castro's 78th birthday, which treated as credible the claims by one of Castro's doctors that Cubans can live 120 years. "Cuba pursues a 120-year-old future," blared the August 13 headline. "Nation strives for world's longest life expectancy," trumpeted the subhead. Reporter Eric Sabo's lead: "There's a good chance that Fidel Castro, who marks his 78th birthday today, could keep going for another 40 years, the Cuban leader's personal physician says." Sabo acknowledged doubters and those who question the accuracy of Cuban health statistics, but he didn't hesitate from passing along ludicrous claims from the Cuban regime, thus giving them credibility. Sabo gushed about how "efforts to improve health here have had remarkable results. More than 15% of Cubans are now 60 years or older. Cuba's infant-mortality and life-expectancy rates are among the best for a developing country." Sabo maintained: "At least 40 different Cuban research groups are said to be at work unlocking the secrets of aging. The research ranges from studying special diets to basic research on genetics." Accompanying the article on page 7 of the news section on Friday, USA Today ran a photo of Castro marching with the doctor behind him. An excerpt from the August 13 article by Sabo, who was listed as "Special for USA TODAY," and datelined from Havana: There's a good chance that Fidel Castro, who marks his 78th birthday today, could keep going for another 40 years, the Cuban leader's personal physician says. "It is very possible to live to 120," says Eugenio Selman Housein, the doctor closest to Castro. And Selman says reaching that remarkable age is something that even average Cubans can achieve. The key, he says, is preventive care and attitude. "If you think you can reach 120 years of age, then it's possible," he says. Castro's aging communist revolution lacks much in the way of money or outside support. Financial help from Moscow dried up after the collapse of the Soviet Union in 1991, and the country has been under a U.S. trade embargo for decades. Undaunted by the country's shaky economic health, Cuban doctors led by Selman have begun a campaign to bolster its physical health: an ambitious fountain-of-youth program called the "120-Year Club."... Not many people would consider Cuba an ideal place to grow old. Cuba had an estimated per capita gross domestic product of $2,800 in 2003, compared with $37,800 for the USA. The elegant buildings that made the island a tourist mecca until Castro's communists took over in 1959 are crumbling.... Electricity outages and food shortages are less pronounced than they were during the lean days of the 1990s, after Soviet support ended. But the government is warning its people of tough times ahead because of Bush administration efforts to force Castro out by further isolating the country. Yet efforts to improve health here have had remarkable results. More than 15% of Cubans are now 60 years or older. Cuba's infant-mortality and life-expectancy rates are among the best for a developing country. The infant-mortality rate is 6.45 out of 1,000 live births, not far behind the USA, where it's 6.63.... In many poor countries, infectious diseases and malnutrition are the biggest killers. But Cuba's vaccination program -- Cuban children get 13 vaccinations -- prevents those diseases.... Coming from a dictatorship, such statistics, even when they are backed up by U.S. government estimates, are often greeted with suspicion.... Anna Alverez, 78, lives in a modest apartment near Havana's main university. She supplements her $8-a-month pension by teaching Spanish to foreign visitors. She groans at the thought of living to 120. ''We can barely live now,'' she says. Alverez would not be a good candidate for the 120-Year Club because of the importance it places on attitude. Cuban officials say the same revolutionary zeal that has driven nearly five decades of socialism can overcome the ravages of time. The 120-Year Club is based on six keys to a longer life: proper nutrition, exercise, culture, a clean environment, preventive health care and willpower. These virtues are being pushed through educational seminars and the government media.... Selman won't say whether Castro is a member of the club, but he points to him as a motivational figure. Selman tells audiences that Castro, through dogged determination, was able to overcome all obstacles to lead Latin America's most enduring revolution. "He is a good example," Selman says. Many observers, however, are less than impressed. "This sounds like another of Castro's many crazy schemes," says Brian Latell, a Latin America expert at the Center for Strategic and International Studies in Washington. Experts on aging also are skeptical.... END of Excerpt For the USA Today story in its entirety: www.usatoday.com -- Brent Baker

Home | News Division

| Bozell Columns | CyberAlerts |

A Congressional Budget Office (CBO) study released on Friday documented that without the Bush tax cuts the top 20 percent of taxpayers would have paid 78.4 percent of all income taxes collected, but thanks to the tax cuts their burden rose to 82.1 percent of income taxes collected while the share borne by the middle 20 percent, which would have been 6.4 percent, fell to 5.4 percent. So how did the media treat this ongoing trend in which the tax burden is continuing to shift toward the wealthiest? By highlighting data from the study which either pointed out the self-evidently obvious and thus hardly newsworthy -- that the higher your income the larger the numeric value of your tax cut -- or by claiming the tax cuts shifted the tax burden away from the wealthy, a contention based upon including taxes untouched by the Bush plan.

A Congressional Budget Office (CBO) study released on Friday documented that without the Bush tax cuts the top 20 percent of taxpayers would have paid 78.4 percent of all income taxes collected, but thanks to the tax cuts their burden rose to 82.1 percent of income taxes collected while the share borne by the middle 20 percent, which would have been 6.4 percent, fell to 5.4 percent. So how did the media treat this ongoing trend in which the tax burden is continuing to shift toward the wealthiest? By highlighting data from the study which either pointed out the self-evidently obvious and thus hardly newsworthy -- that the higher your income the larger the numeric value of your tax cut -- or by claiming the tax cuts shifted the tax burden away from the wealthy, a contention based upon including taxes untouched by the Bush plan.  On screen, as Quintanilla began, NBC placed a graphic of the cover of the CBO report, with a very dry title of "Effective Federal Tax Rates Under Current Law, 2001 to 2014," overlaid by NBC News with:

On screen, as Quintanilla began, NBC placed a graphic of the cover of the CBO report, with a very dry title of "Effective Federal Tax Rates Under Current Law, 2001 to 2014," overlaid by NBC News with:

Brit Hume argued on Sunday that John O'Neill's book, Unfit for Command: Swift Boat Veterans Speak Out Against John Kerry," is "full of footnotes. It has an appendix. It's a pretty serious piece of work" and so "it is entitled to at least as much attention -- and the charges are entitled to at least as much attention -- as was given the charge that President Bush went either 'AWOL,' Terry McAuliffe's words, or 'deserted,' those were Michael Moore's words -- that triggered a firestorm and a huge feeding frenzy."

Brit Hume argued on Sunday that John O'Neill's book, Unfit for Command: Swift Boat Veterans Speak Out Against John Kerry," is "full of footnotes. It has an appendix. It's a pretty serious piece of work" and so "it is entitled to at least as much attention -- and the charges are entitled to at least as much attention -- as was given the charge that President Bush went either 'AWOL,' Terry McAuliffe's words, or 'deserted,' those were Michael Moore's words -- that triggered a firestorm and a huge feeding frenzy."