|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||

|

||||||

|

||||||||||||||||||

|

||||||||||||||||||

|

|||||||||

|

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

Liberal Spin Prevails: by Rich

Noyes, Director Liberals have attacked President Bush’s proposed tax reduction package as a risky scheme and a massive, budget-busting giveaway to the rich. Tax cut proponents have countered that by various historical measures Bush’s tax cut is hardly excessive, and have argued it provides a greater percentage tax reduction to lower- and middle-income households than it does to wealthier families. So which set of opinions has held sway on the three evening newscasts since Bush’s inauguration? To find out, the Media Research Center’s Free Market Project (FMP) analyzed ABC’s World News Tonight, CBS Evening News, and NBC Nightly News during the first ten weeks of the Bush administration, from January 20 through March 31, 2001. During this period, the network evening broadcasts produced more stories about the President’s tax cut proposals than any other Bush administration initiative. In all, our study identified and examined 93 broadcast network news stories during this ten week period. Combined, the ABC, CBS and NBC evening newscasts aired 55 full reports about Bush’s tax policies, plus another 19 anchor-read briefs, for a total of 74 stories. An additional 19 field reports which were not mainly focused on taxes, but which contained substantial discussion of tax policy, were also included in the study.

Sizing Up the Tax Cut: Reporters Side With Liberal Critics In their review of these stories, FMP researchers tallied 94 judgments about the size of the Bush tax cut, 84 percent of which labeled it as "big" or "huge" or otherwise portrayed it as large. Many of these (46) were the reported comments of tax cut opponents. North Dakota Senator Kent Conrad, for example, was shown on ABC on February 5 declaring that "this tax cut is simply too big," while CBS on February 27 displayed former Clinton budget chief Jack Lew claiming of Bush’s plan, "there’s a real risk that it doesn’t all fit. And if it doesn’t all fit, you’re either going to be spending more than you mean to or not doing things that are very important." These remarks from partisan sources were an expected part of the debate surrounding the tax program, and they demonstrate the fact that judgments about the size of the overall package were not neutral observations. Liberal sources cited the bigness of Bush’s tax package as a key reason for their opposition, claiming that a too-severe reduction in revenues could either force a resumption of budget deficits or unwanted cuts in federal programs.

But reporters were guilty of more than simply failing to maintain a balance in their choice of news sources, since about one-third of the judgments about the scale of Bush’s tax cut (30 statements, or 32% of the total) were expressed by network correspondents as their own opinion, and all of these comments by reporters reflected the liberal perspective that the proposed tax cut was large. Most of these assessments from reporters came on CBS and NBC, each with 14 such comments. Correspondents on ABC’s World News Tonight were far more neutral, casting the Bush tax cut as large only twice. (See Exhibit 2: "Assertions By Reporters That Bush’s Tax Cut Is Large")

Contrary Information Omitted When reporters validate one side’s partisan claims by embracing them as their own, they signal audiences that those partisan claims are essentially correct. In the case of the Bush tax cuts, there was ample evidence that the overall magnitude of these tax proposals was comparatively small, yet the networks persisted in repeating the claim of liberal partisans that the cuts were large. Reporters frequently stated that the overall size of the tax package was $1.6 trillion, but usually omitted that this was the accumulated total over a ten-year period. NBC’s weekend anchor John Seigenthaler, on February 4, was the only correspondent during this time period to clearly state this point in his presentation of "the President’s plan to cut taxes by $1.6 trillion over ten years." This more complete description of the tax cut’s size makes it seem far less formidable. Under current law, federal revenues are expected to total about $28 trillion during this same ten-year period, meaning that the total tax reduction package amounts to less than six percent of the total anticipated revenue. Further, all of the network coverage has relied on statistics derived from "static analysis" of the budgetary consequences of the President’s program. A "static analysis" does not take into account the fact that consumers, investors, workers and businesses will respond to lower tax rates by changing their behavior in ways that will lead to more economic growth. These changes in economic behavior are widely understood and expected — one reason why tax cuts are generally recommended when the economy is weak. According to a detailed research paper recently distributed by the Heritage Foundation to more than a thousand members of the media — including those at ABC, CBS and NBC — a "dynamic analysis" of the Bush tax cut that considered these changes in economic behavior indicated that "because the tax relief would increase economic growth and employment, the larger tax base would generate $846 billion in tax revenue that is unaccounted for in a static analysis," slicing the estimated "cost" of the tax cuts by 47 percent.

None of the networks even hinted at the Heritage and NTU studies, nor was there any evidence that they altered their commentary about the tax cut’s size after being presented with these contrary facts. The Heritage paper was specifically prepared to offer a factual rebuttal to the Concord Coalition, whose claims that the Bush tax cut was dangerously large were publicized on ABC’s World News Tonight and the NBC Nightly News. Yet none of the networks told viewers about either of these studies; doing so would have enabled audiences to think more critically about reporters’ labeling of the tax package as "big" and "huge."

Who Benefits? Liberal Arguments Presented With Little Context The other key complaint voiced by liberal critics about the Bush tax cut is its alleged unfairness — i.e., the tax cuts are merely a giveaway to the rich that offer little or nothing to lower- and middle-income households. This perspective was repeated on the networks 31 times, mainly by Democrats lobbying against the tax cut proposal or reporters summarizing the liberal complaint. For example, CBS’s Rather introduced a story on February 8 by informing viewers that "Democrats said again the Bush cuts are mostly a boon to the rich, and they say the cuts risk squandering the nation’s budget surplus."

Liberals pushed their argument by stressing the raw dollar savings for families at different income levels. Nine times, the evening news presented Senate Democratic Leader Tom Daschle making this liberal point. At one photo-op (shown on all three broadcasts), he asserted that "if you make over $300,000 a year, this tax cut means you get to buy a new Lexus. If you make $50,000 a year, you get to buy a muffler on your used car." Democratic Congressman Lloyd Doggett was displayed on NBC on March 8, asserting that under the Bush plan, "you can use your big tax savings to buy a can of beans daily." Fairness would mean reporters would have balanced liberals’ favored citation of raw dollar totals with information on the percentage tax reduction for various households, as conservatives favored. Yet the networks rarely did this. The only exceptions: NBC on three occasions, and ABC once, summarized data showing the percentage reduction in the tax burden facing families with different incomes. These data made it clear that the rich would not receive the largest percentage tax cuts. One of those exceptions: ABC’s Terry Moran offered both sets of numbers on February 8, explaining that "under the Bush proposal, a single person making $20,000 a year would get a $300 tax cut. That’s 16 percent less than the person pays in taxes now. A married, working couple with two children who make $60,000 a year would get a $1,600 cut, which represents a 40 percent reduction from current law. And, a married couple with two children making $1,000,000 a year would get a $46,000 tax break, a 15 percent cut." Not only does this show that the rich weren’t getting the greatest percentage tax cut; working backwards, those figures also indicate that the higher-income couple is currently paying more than $300,000 each year in federal income taxes. As a tax expert told Moran, "Poor people do not get the same big tax cuts that high-income people get under this plan. That’s because they don’t pay large amounts of tax."

In other words, many millions of Americans are already essentially excluded from the burdens of an income tax, so any changes in tax rates cannot be expected to have a great effect on their tax bills. Conversely, the wealthiest citizens account for such a large portion of the federal tax pie, it is difficult to reduce income tax rates without substantially reducing the tax bills of wealthy citizens. The even-handed approach that Moran displayed on February 8 was discarded a month later by his colleague, ABC congressional reporter Linda Douglass, who on March 8 read a description of the benefits of the across-the-board income tax cut that could have been written by Daschle’s press secretary. "People making $56,400 would get back $511 a year," she told viewers. "Those making $1,000,000 would get back more than $28,000." She never hinted at the fact that the lower-income household in her example was obtaining a larger percentage cut than the high-income family, or that the high-income family was responsible for far larger payments to the government. To their credit, three stories on NBC offered viewers this counter-argument. "What about the charge that the plan mostly benefits the rich? Not so, say some experts," reporter David Gregory explained on February 5. "As a percentage of their tax liability, the rich actually get a smaller cut than many others." This point was not made frequently enough on either ABC or NBC to come close to balancing the 31 claims of liberal partisans who were repeatedly shown stressing the supposed unfairness of the tax cut, but both networks deserve at least some credit for offering viewers a rare glimpse of the other side of the story.

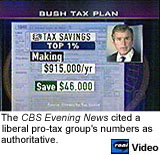

CBS Excluded Data Rebutting Liberal Critics While ABC and NBC downplayed alternative data that countered the liberal argument that the tax cuts were unfair, the CBS Evening News refused to report this information even a single time. Instead, on three occasions CBS reporters chose to make precisely the same point as Democratic partisans, emphasizing that the net tax reduction of the wealthiest citizens would have the highest raw dollar value.

The on-screen graphic explained that the "one analysis" cited authoritatively by Roberts was in fact a study by a group called Citizens for Tax Justice, which Roberts failed to tell viewers was a liberal interest group. Roberts made a similar presentation on February 8 ("a married couple with no children making $950,000 a year would get back almost $9,000 in the first year, more than $43,000 in the fifth"), while Capitol Hill correspondent Bob Schieffer pushed the same point on March 8, the day the House of Representatives passed the across-the-board income tax cut. "For a single parent with one child earning $22,000 a year, that translates into a savings of $932 once the full cut is phased in," Schieffer lectured as the numbers flashed on screen. "A two-earner couple with two children earning $55,000 will realize a $1,900 a year tax cut. The same size family earning $90,000 would see a cut of more than $2,700. And if that family’s earnings rose to $400,000, their tax cut would total more than $13,000 yearly." As the information relayed by ABC’s Moran and NBC’s Gregory makes clear, those dollar figures stressed by CBS are practically meaningless if you don’t know how much an individual is already paying the federal government in income taxes. A basic outline of the tax burden that current law places on various income groups is undoubtedly relevant to any discussion of the "fairness" of any changes in income tax rates, yet it was nowhere to be found on the CBS Evening News. Nor was any mention made of the income tax increase which the Clinton administration pushed through a Democratic-controlled Congress in 1993 as part of a plan to reduce and eventually eliminate large annual budget deficits. The Clinton tax increase, sold as part of a program of "shared sacrifice," only increased income tax rates on upper-income households, raising the top rate from 31 percent to 36 percent, and then creating a "millionaires surcharge" of ten percent — a de facto top bracket of 39.6 percent for those with the largest annual earnings that has been in place ever since. Despite the fact that those deficits have disappeared, even the Bush tax cut would only return the top rate to 33 percent, two points higher than it was when Bill Clinton took office. This context, however, was never included in a single network story, even as many of the liberal Democrats who voted for the 1993 tax increase condemned as "unfair" and "a giveaway" even a partial rollback of those higher rates. The fact that the CBS Evening News dutifully reported the liberals’ complaints about the tax cut’s "unfairness," yet completely excluded facts and data which might offer a convincing rebuttal, ensured that viewers would hear only one side of the debate.

The CBS Evening News Promoted the Idea that Tax Cuts Are Dangerous A key argument of tax cut supporters is that a significant reduction in the federal tax burden would benefit the economy. During the presidential campaign, Bush advocated cutting tax rates to ensure long-term growth; during the transition and in his first ten weeks in office, Bush additionally argued that enacting tax cuts this year would help speed the economy’s recovery from its current slowdown. "I strongly believe that a tax relief plan is an important part of helping our country’s economy recover," the President was shown stating on NBC on February 5. This argument on behalf of the tax cut was reported on all three network broadcasts. On NBC, this pro-tax cut argument actually dominated the debate, while on ABC it was relatively balanced with the liberal counter-arguments that the Bush tax cut would either offer no assistance to the economy, or do more harm than good. For example, on March 15, ABC showed the comments of House Democratic leader Richard Gephardt: "This tax cut does not stimulate the economy; in fact, I would argue to you it’s having an opposite effect."

A few moments later on the same night, CBS’s Bob Schieffer paraphrased Democratic "fear that anything larger [than the $800 billion cut proposed by Daschle and Gephardt] could set off the kind of red ink spending that produced the enormous deficits of the 1980s." Schieffer’s report, billed by anchor Rather as a "Real Deal" analysis "beyond the photo-ops and spins," was strictly limited to presenting the Democratic arguments against Bush’s tax cut. On February 8, Rather introduced a story by countering the conservative point that lowering tax rates would help the economy. Citing unnamed experts, he paraphrased their view of Bush’s tax cut: "Some economists worry that it’s a long term risk." The story that followed, by John Roberts, failed to follow through by showing an actual economist — or anyone else — making that point. On February 10, a story by Wyatt Andrews strained to fault the Bush administration for encouraging Congress to make the tax cuts retroactive, but not actually sending the legislative language to the Hill. "The jump start, part of the sales pitch, is not yet part of the plan," he alerted viewers. The not-so-subtle point, in the words of weekend anchor Thalia Assuras, was that "the cuts would not be of any immediate help." On February 19, CBS decided that it was national news that a New York City priest, Father Bill Greenlaw, thought that Bush’s idea to eliminate the estate tax would harm charities. "This is crazy, in my judgment, to think about eliminating that so that the most wealthy of our society can become still more wealthy," Father Greenlaw told CBS’s Jim Axelrod. On February 27, Rather opened the Evening News by saying the President would, in his address to Congress that evening, make "a TV pitch for a tax cut gamble." The next night, Rather again cited economists whom he wouldn’t name and who didn’t appear in the follow-up story, proclaiming that "Democrats and some independent economists believe the Bush push is risky business." Neither ABC nor NBC ever went so far as to label the President’s program a "gamble," and neither of the other broadcasts ever cited the worries of unnamed experts as a way of validating the claims of liberal tax cut opponents. In its presentation of the debate over whether Bush’s tax cut would help or harm the U.S. economy, the CBS Evening News displayed news judgment that placed it to the left of even its two broadcast evening brethren.

Conclusion: Liberal Spin on All Three Networks, but CBS Was the Worst In its coverage during the first ten weeks of the Bush administration, the CBS Evening News displayed a unique antagonism toward the tax cut and the arguments made on its behalf, while obliging its liberal critics by frequently reciting their arguments against the tax cut. Neither ABC nor NBC could ever be confused with promoters of the tax cut, to be sure, but both World News Tonight and the NBC Nightly News offered viewers an occasional glimpse of conservatives’ perspective on these key points. ABC, for example, was more restrained than either of its competitors when it came to the debate over the size of the Bush tax cut. As on CBS and NBC, it skewed its stories to give more airtime to liberal critics who complained that the tax cut was "big" or "huge" (by a margin of 15-3), but its own on-air personalities generally did not repeat such partisan rhetoric themselves. On occasion, ABC anchor Peter Jennings referred to it as a "broad-based tax cut" or an "across-the-board" tax cut, but he avoided the blunt language used by CBS’s Rather and NBC’s Brokaw which left no doubt of their personal view of Bush’s tax proposal. More than its competitors, NBC juxtaposed the complaints of liberal critics that the Bush tax cut was unfairly tilted toward the wealthy with a glimpse of data showing the other side of the story. In three stories, NBC reported that lower- and middle-income families receive a larger percentage tax cut than the rich. That’s not the whole story, of course, but it’s a necessary fact to include in any debate over the perceived fairness of the Bush tax cut. Those three stories couldn’t overshadow the 14 instances in which liberal politicians were able to claim on Nightly News that the Bush cut was unfair, but those three stories made NBC more balanced than CBS, which failed to ever report this basic fact. If a single anecdote can illustrate hostility toward the tax cut, then consider: On February 27, President Bush outlined his tax and budget plans before a joint session of the U.S. Congress. That night, CBS News paid for a professional poll to be conducted after the speech. A scientifically-drawn random sample of 978 Americans who watched the speech were surveyed, and the results were properly reported on CBS’s Web site and its morning news program, The Early Show. But the scientific survey found that most of those who watched liked Bush’s programs in general, and two-thirds (67%) said they liked his tax cut in particular. Instead of telling viewers this positive fact about the tax cut, the CBS Evening News buried the poll. Reporter John Roberts chose to interview two women in a coffee house in Omaha, Nebraska, one of whom thought the tax cut should be reduced and another who opposed it outright. Here’s a transcript of the relevant portion of that report:

Roberts’ report might have been excusable if CBS had not been sitting on a poll showing that, in stark contrast to his informal survey at the coffee shop, most of the public (including 48% of the Democrats surveyed in CBS’s scientific poll) favored the tax cut. After suppressing a poll showing support for Bush’s larger tax cut, the next night Roberts told viewers about a survey that an unnamed competitor to CBS News had conducted. After running a quick clip of Republican Congressman Tom DeLay criticizing a Democratic tax bill as "nothing more than a redistribution of wealth," Roberts immediately undercut him: "New polls, however, show voters leaning slightly in favor of the Democratic plan." It is not clear what "new polls" Roberts was citing, but a likely source was a Reuters-Zogby poll released on that day which did report that 40 percent of those surveyed supported the Democrats’ proposed $800 billion tax cut, compared with 38 percent who backed Bush’s cut. If it was the Reuters-Zogby poll, then it’s worth pointing out that eight percent of the public rejected both cuts, preferring an even greater tax cut. It is remarkable that after weeks of hearing that the tax cut is too big, too unfair, and perhaps a danger to the nation, a large segment of the population remains supportive of President Bush’s tax cut plan, and a great number of citizens want even greater tax reduction. But there is still no escaping the basic fact that the networks in general, and the CBS Evening News in particular, have failed to offer their audiences anything close to a balanced and fair debate on the key issues involved in the tax cut debate of 2001.

Home | News Division

| Bozell Columns | CyberAlerts

|

Although

not nearly as frequently as they quoted tax cut critics, the networks also

quoted sources refuting this argument, including statements from President

Bush emphasizing his belief that the tax cut was the right size, and some

congressional Republicans who argued that the size of the tax cut should

be increased. Yet taken together, these views only amounted to 16 percent

of the total opinions on the size of the tax package, meaning that these

voices were outweighed five-to-one by those who criticized the largeness

of the tax cut. (See Exhibit 1: "Labeling Bush’s Tax Cut")

Although

not nearly as frequently as they quoted tax cut critics, the networks also

quoted sources refuting this argument, including statements from President

Bush emphasizing his belief that the tax cut was the right size, and some

congressional Republicans who argued that the size of the tax cut should

be increased. Yet taken together, these views only amounted to 16 percent

of the total opinions on the size of the tax package, meaning that these

voices were outweighed five-to-one by those who criticized the largeness

of the tax cut. (See Exhibit 1: "Labeling Bush’s Tax Cut")

CBS’s

Dan Rather uttered this opinion more than any other correspondent,

branding the President’s tax plan as "big" eleven times.

NBC’s Tom Brokaw used more varied language to convey his views about the

size of Bush’s program, calling it either "big," "very

big," or "massive" a combined total of ten times. These two

anchors together accounted for nearly two-thirds (64%) of the reporters’

commentary on this topic, and more than one-fifth (22%) of all of the

opinions on this topic from all sources

CBS’s

Dan Rather uttered this opinion more than any other correspondent,

branding the President’s tax plan as "big" eleven times.

NBC’s Tom Brokaw used more varied language to convey his views about the

size of Bush’s program, calling it either "big," "very

big," or "massive" a combined total of ten times. These two

anchors together accounted for nearly two-thirds (64%) of the reporters’

commentary on this topic, and more than one-fifth (22%) of all of the

opinions on this topic from all sources

Additionally,

a study by the

Additionally,

a study by the  That

same evening, ABC quoted the President making the opposite point, telling

Hispanic business leaders, "My plan dramatically reduces the marginal

rate on many low-income workers." But this counter-argument — that

Bush’s plan offered tax relief to all income taxpayers, or that his

program actually provided a larger percentage cut in the tax bills of

lower- and middle-income taxpayers — was relayed to viewers less than

half as frequently (15 times) as the liberal assertion that the tax cuts

were "a boon to the rich." (See Exhibit 4: "Debating the

Fairness Issue")

That

same evening, ABC quoted the President making the opposite point, telling

Hispanic business leaders, "My plan dramatically reduces the marginal

rate on many low-income workers." But this counter-argument — that

Bush’s plan offered tax relief to all income taxpayers, or that his

program actually provided a larger percentage cut in the tax bills of

lower- and middle-income taxpayers — was relayed to viewers less than

half as frequently (15 times) as the liberal assertion that the tax cuts

were "a boon to the rich." (See Exhibit 4: "Debating the

Fairness Issue") Exhibit

5, "Most Taxes Paid By Top Earners," makes this point even more

clearly. According to data provided by the Internal Revenue Service and

the Tax Foundation, and published in Investor’s Business Daily on

February 8, under current law, the top five percent of income earners

shoulder more than 50 percent of the federal income tax burden, while the

bottom 50 percent of income earners pay only about four percent of federal

income taxes. The top one percent of earners — those singled out in so

much liberal rhetoric — account for more than one-third (34.8%) of the

government’s income tax revenue.

Exhibit

5, "Most Taxes Paid By Top Earners," makes this point even more

clearly. According to data provided by the Internal Revenue Service and

the Tax Foundation, and published in Investor’s Business Daily on

February 8, under current law, the top five percent of income earners

shoulder more than 50 percent of the federal income tax burden, while the

bottom 50 percent of income earners pay only about four percent of federal

income taxes. The top one percent of earners — those singled out in so

much liberal rhetoric — account for more than one-third (34.8%) of the

government’s income tax revenue.

But

on the CBS Evening News, the argument that tax cuts were beneficial

was treated minimally, while the liberal talking point that tax cuts were

dangerous was featured far more than on either ABC or NBC. (See Exhibit 6,

"Would the Tax Cut Help?") On February 5, for example,

correspondent John Roberts gave airtime to an unlabeled liberal activist

who cited Ronald Reagan as proof that too much tax cutting was a terrible

thing: "Bob McIntyre of Citizens for Tax Justice can’t forget the

last time Congress went on a tax cut spree in 1981; America is still

paying the bill," Roberts lectured, once again failing to mention

McIntyre’s liberal credentials.

But

on the CBS Evening News, the argument that tax cuts were beneficial

was treated minimally, while the liberal talking point that tax cuts were

dangerous was featured far more than on either ABC or NBC. (See Exhibit 6,

"Would the Tax Cut Help?") On February 5, for example,

correspondent John Roberts gave airtime to an unlabeled liberal activist

who cited Ronald Reagan as proof that too much tax cutting was a terrible

thing: "Bob McIntyre of Citizens for Tax Justice can’t forget the

last time Congress went on a tax cut spree in 1981; America is still

paying the bill," Roberts lectured, once again failing to mention

McIntyre’s liberal credentials.