|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||

|

||||||

|

||||||||||||||||||

|

||||||||||||||||||

|

|||||||||

|

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

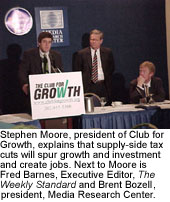

Statement Of L. Brent Bozell III On "Liberal Spin Prevails: How CBS Led the Networks’ Charge Against the Bush Tax Cut" April 13, 2001 Good morning. I’m here today to discuss the findings of the Media Research Center’s newest Special Report, "Liberal Spin Prevails: How CBS Led the Networks’ Charge Against the Bush Tax Cut."

MRC analysts found 93 such stories, and what can only be described as a blatant, overwhelming bias on the part of the so-called "news" media against the Bush tax cut. Six patterns of bias emerged. First, we found that the networks were five times as likely to quote liberal critics of the tax cut charging it was "massive" or "huge" than they were to quote supporters making the opposite point. Worse still was the second pattern: network anchors and reporters themselves expressed the judgment that Bush’s tax package was "big" or "very big" on 30 different occasions. It should not come as a surprise that not once did a reporter label Bush’s cut small or even modest. Third, the evening news programs broadcast complaints from liberal tax cut opponents (such as Senator Tom Daschle) that the tax cut is unfairly skewed in favor of the wealthy twice as often (31 times) as the contrary point of view (15 times). The fourth pattern that emerged in our analysis was a matter of bias by omission limited to CBS. Dan Rather’s CBS Evening News never once revealed data reported on both the NBC Nightly News and ABC’s World News Tonight that demonstrated Bush’s plan offered a greater percentage tax reduction to lower- and middle-income families. The fifth pattern that emerged over the 93

stories in the data set was also one of bias by omission, though this time

network-wide. From January 20 through March 31, not one of the networks

reported that the last income tax increase, passed in 1993, targeted

higher income families. Nor in the study period did any network ever tell

viewers that the top five percent of earners currently shoulder more than

half of the tax burden. Nor did any reporter ever report that the top one

percent of earners pay more than one-third of all federal income taxes. The final patterns of media bias against the Bush tax cut: while all three networks tilted their coverage in favor of tax cut opponents, the CBS Evening News displayed a unique antagonism toward the tax cut and the arguments made on its behalf. For example, in his introduction to the February 27 CBS Evening News, objective newsman Dan Rather referred to Bush’s program as a – quote – tax cut gamble. Later in the same show, unopinionated Rather referred to it as Bush’s – quote – cut-federal-programs-to-get-a-tax-cut plan. The very next night, Dan Rather told viewers – quote – some independent economists believe that Bush push is risky business. How odd: Rather never identified these independent economists to whom he referred, nor were they featured in the segment that followed. (We can say with certainty that this was the standard mantra of Al Gore.) Of all the nightly newscasts, CBS Evening News was the least likely to relay comments from Bush or other tax cut supporters promoting the economic benefits of a significant tax cut, and gave the most time to the liberal claim that the tax cut would harm the nation or do a poor job of relieving the current economic slowdown. And of the 14 instances in which CBS’s on-air correspondents personally labeled the proposed cut "big" or "massive," it was Dan Rather himself sticking the liberal label to the plan in 11 of those 14 instances. Given the dismal coverage tax cuts have received over the past weeks, it’s a wonder Americans still support them. And despite the media’s best efforts, Americans do support tax cuts. Gallup surveys have found support for lower tax rates has stayed above 70% for the past quarter-century. But savvy liberal politicians and their handmaidens at ABC, CBS and NBC know Americans can be talked out of tax cuts if they believe they will harm the nation. And that’s exactly the liberal line the networks have toed for the past 10 weeks.

There are three steps the networks can take today to begin to balance their coverage of the tax cut debate. First, they must stop calling the tax cut "massive" or "huge." These are liberal swear words designed to denigrate the tax cut. Moreover, this is an unfair characterization. Compared to previous tax cuts, Bush’s proposal can best be described a modest. Reagan’s 1981 tax cut was three times as big and JFK’s in 1963 twice as big as Bush’s. Second, the network evening news need to balance their guest lists. No one can pretend that 31 tax cut opponents compared to 15 supporters makes for balance on the nightly news. Third, the networks need to provide context. If one is going to have a debate about the fairness of proposed changes to the tax code, one ought start by looking at the fairness of the current tax code. For example, not one of the networks has yet to report that the last income tax increase, passed in 1993, solely targeted higher income families, nor did any of the networks to tell viewers that the top one percent of earners pay more than one-third of all federal income taxes. These three recommendations cannot compensate for 10 weeks of liberally-biased network news coverage of the tax cut debate. But if implemented, they would make network coverage of this important matter of public policy if not even-handed, at least slightly more bearable.

Home | News Division

| Bozell Columns | CyberAlerts |

The

study analyzed all of the stories about the President’s tax cut proposal

that aired on the evening newscasts of ABC, CBS and NBC over the 10 weeks

from Inauguration Day through March 31.

The

study analyzed all of the stories about the President’s tax cut proposal

that aired on the evening newscasts of ABC, CBS and NBC over the 10 weeks

from Inauguration Day through March 31.

The

Media Research Center doesn’t expect nor want Dan Rather, Peter Jennings

and Tom Brokaw to suddenly push for tax cuts; what we do want and expect

is more balanced coverage.

The

Media Research Center doesn’t expect nor want Dan Rather, Peter Jennings

and Tom Brokaw to suddenly push for tax cuts; what we do want and expect

is more balanced coverage.